As to the reasons Prefer Treadstone for your Traditional Home loan

Totally free South carolina Coins Sep 2024 More than 100+ Free South carolina Gold coins

6 oktobra, 2024Earliest Tech Credit Partnership: $3 hundred Benefits Checking account Incentive

6 oktobra, 2024As to the reasons Prefer Treadstone for your Traditional Home loan

- Versatile conditions: Conventional Money promote numerous label lengths, and fifteen-seasons, 20-year, and you will 29-12 months selection.

FHA rather than Traditional Fund

Traditional Money and FHA Financing try each other version of mortgage loans which have low-down payment selection which can be widely used from the house people within the Michigan. Although not, he has got specific key variations one borrowers should be aware of, also it is not always the situation you to Conventional Fund operate better than simply FHA.

One of many differences when considering Antique Loans and FHA Funds ‘s the credit history requirements. FHA Fund are apt to have lower credit rating conditions than Traditional Loans, leading them to a good option having consumers that have smaller-than-perfect credit. However, it is sold with a swap-off: FHA Financing wanted financial insurance rates on the lifetime of the loan, that may add to your general prices.

A different sort of difference between both sort of financing is the down percentage needs. FHA Financing usually need a reduced down payment than conventional fund, of at least step three.5% for some consumers. This will build FHA Money advisable to have very first-day home buyers and for those who might not have the fresh funds for a more impressive advance payment.

In terms of financing constraints, FHA Money normally have straight down limits than just Conventional Fund. This means that FHA fund is almost certainly not designed for higher-cost belongings in certain portion. But not, FHA Loans may accommodate higher loans-to-income percentages, which is ideal for individuals having increased level of financial obligation.

Overall, each other Conventional Money and you may FHA Money has their particular band of masters, additionally the right choice for you is based on your financial condition and your requires once the a debtor. It is essential to very carefully examine the fresh regards to each kind out of financing and you may think speaking with a monetary advisor or home loan bank to choose and therefore choice is an educated complement your.

- Individualized service: Local lenders offer a great deal more custom services and you may focus on their private need than the a larger lender.

- Flexibility: Local mortgage lenders is generally more versatile and you may ready to really works with you to acquire a home loan solution that meets your unique financial situationplex sale dont frighten you!

- Expertise in local business: Treadstone provides good comprehension of the local housing market together with certain financial products that come in our very own town.

- Easier area: Treadstone provides workplaces when you look at the the downtown area Huge Rapids, Holland, Grand Haven, Kalamazoo, and you can Marshall. You are thank you for visiting go to the work environment privately to talk about your own financial solutions and you will complete the software procedure.

- People engagement: We have been involved in the people, and you will love help local businesses and you may communities.

The first measures!

You want a normal Loan into the Michigan? Connect with a financing masters for lots more information or rating pre-recognized! Every guidance- zero pressure.

Faqs

Yes, customers just who meet the qualification standards to have a traditional Financing is also place as low as 3% upon their brand new domestic! For down money less than step three%, here are a few the 0% off loan selection.

Never! Conventional Loans high risk personal loan brokers in Kingston Missouri can be used having only step three% down, but you will find positive points to position a downpayment of 20% or maybe more.

Yes, positively. Established home owners and you may first-time homebuyers exactly who meet the Traditional Loan requirements for such things as money, borrowing, and you can property position, could probably have fun with a traditional mortgage.

The three% down Conventional (also known as the standard 97 LTV) has been around for many years, and must continue to be a familiar financing device for decades in the future.

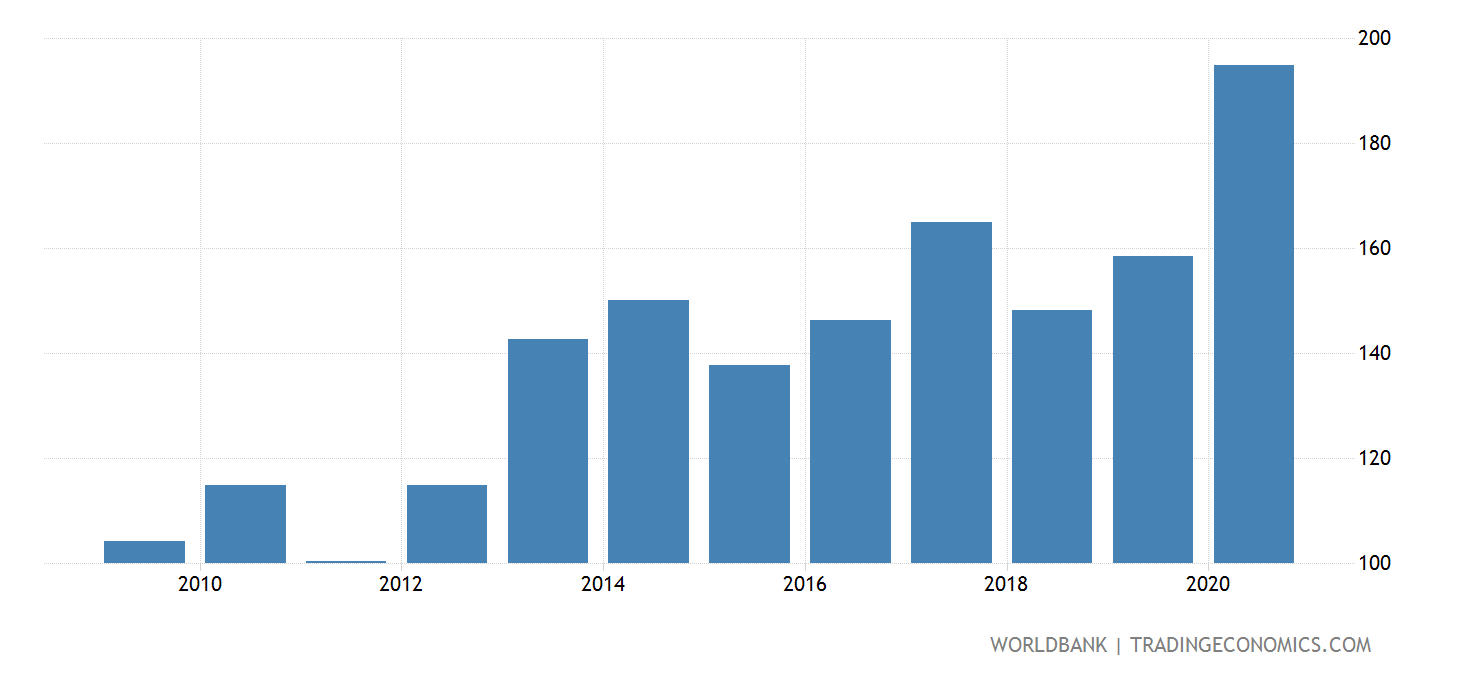

Lower than try an up-to-go out graph to your standard interest rate style for Antique Funds. The newest costs listed here are to possess academic motives just. Displayed rates imply trends and generally are not rates provided by Treadstone Resource to any variety of borrower, while the rates of interest are influenced by activities also borrowing, loan amount, and more.