Get back home mortgage pre-recognition on the internet inside the around three steps

Europaplay To try out Mr Options ten A lot more Corporation To remain

6 oktobra, 2024New Part Your credit rating Plays in getting a mortgage

6 oktobra, 2024Get back home mortgage pre-recognition on the internet inside the around three steps

Blog post bottom line

- Pre-recognition has your a solid notion of what you can pay for, allowing you to house appear with full confidence. You can purchase pre-accepted on the web that with equipment like the ooba Bond Indication, which provides an instant, easy, Do-it-yourself, user-friendly feel.

- The connection Indication will need one enter into specific information about your bank account, it uses to decide the affordability, and you will determine how big is our home mortgage you are more than likely to help you be eligible for.

- It’s going to perform a credit check, to choose your credit rating.

- Because processes is finished, you may be issued that have a good prequalification certification, which will show vendors that you’re a serious buyer.

It is advisable to be prepared, specially when and work out a financial commitment while the high while the that of to order a house. This is how providing financial pre-approval on line helps you streamline our home-to acquire processes.

As to why get back home financing pre-approval on the internet?

Mortgage pre-approval requires one read a prequalification process, where you bring specific financial suggestions, which is after that used to assess the size of the home mortgage you probably qualify for. You will be given your credit rating as part of your prequalification procedure.

It might seem eg too many even more work, but it is very beneficial to understand this guidance available to you. Below are a few of the reasons as to why prequalification is actually the desires:

- It offers you with a concept of what you can pay for, to household search with certainty. You won’t want to choose a particular home after a good much time research, merely to discover afterwards which you can not afford it.

- It offers your along with your credit rating, that finance companies will use to determine how much cash out of a beneficial risk youre. Your credit rating indicates into the financial in the event the earlier personal debt payment behavior will make you an effective exposure or otherwise not.

- It offers you having an excellent prequalification certificate, which you can then present to a home broker to show you done your own homework and you indicate organization.

- The seller of the property is far more planning to conduct business which have someone who currently keeps a strong sign, when it comes to pre-recognition, that they can pay the home.

You’ve got the option of getting in touch with a lender otherwise bond inventor personally and receiving pre-passed by a specialist, however it is reduced, convenient and simpler to do it on the web yourself. Here are three points in order to doing so:

step one. Look for a home loan evaluation service

A mortgage research service will usually deliver the substitute for submit an application for pre-acceptance, but some home loan comparison providers become more top-notch as opposed to others. Since they also can connect with several banks having property loan for you, you need to choose home financing analysis services that has good connection with financial institutions and that’s happy to fight the area whenever discussing that have banking institutions.

When it comes to prequalification, you must have a help that makes the method easy and quick. Including, ooba home loans, that’s South Africa’s top home loan evaluation service, brings a totally free, Do-it-yourself, on line tool, the text Originator, which will take your through the pre-approval techniques step by step, in the comfortable surroundings of your own home.

dos. Provide them with the desired suggestions

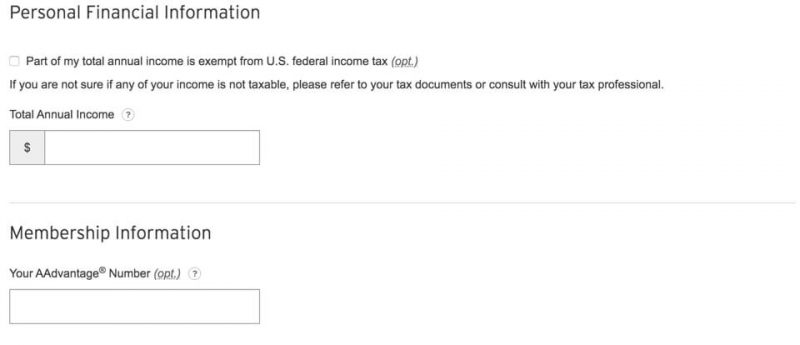

The latest pre-acceptance process will demand that promote individual and you can economic information that will allow the brand new prequalification equipment in order https://availableloan.net/installment-loans-ar/el-paso/ to estimate your value, and to check your credit score.

- Discover the newest ooba Thread Indication: sign.ooba.co.za

step 3. Prequalification certificate

Just after you are complete, you may be awarded which have a good prequalification certification, as possible give a house representative otherwise household merchant. The latest certificate is true to possess 90 days, and then you’ll end up contacted from the financial testing service with the intention that your debts has never changed in any way, just before providing you with the choice so you can prequalify again.

Be aware that this new prequalification certification does not make certain the lending company will provide you with a home loan. They still have to manage their value and you can borrowing inspections, and you can assess the property you decide buying so they can just take their value into consideration.

But as a result of pre-approval, there are selected a home more likely to slip inside debt form, meaning that change your probability of acquiring a mortgage. As you will discover your credit rating, you could potentially determine if or not you ought to focus on enhancing your credit score before applying to own home financing.

Applying for home financing

Once you’ve acquired pre-recognized, and found a property which is in your form, you can register the expertise of a home loan analysis service for example ooba mortgage brokers so you’re able to sign up for an excellent mortgage. Since they apply at multiple banking institutions for you and you will examine rates, they may safe a mortgage contract even better than the one to your believe you would get centered on their pre-recognition.

However they offer a variety of systems which make the house to buy processes simpler. Start with their thread calculator; next explore their free, on the web prequalification device, brand new ooba Bond Signal, to find prequalified and discover what you could manage. Fundamentally, before you go, you could potentially apply for home financing.