The way to get a mortgage when youlso are notice-operating

Daddy – официальный сайт казино и его преимущества – iOS

2 oktobra, 2024Is My personal Credit score Rise a hundred Things within a month?

2 oktobra, 2024The way to get a mortgage when youlso are notice-operating

ontrary so you can well-known faith, there isn’t any special’ classification to own mortgages geared towards brand new thinking-functioning. Freelancers, team administrators and builders can put on for the same mortgage points while the folks.

While you are operating borrowers can simply reveal loan providers the payslips, self-working consumers generally have a whole lot more unpredictable and you can advanced profits, so need a means to show their earnings.

Before 2014, it actually was a new globe to own mind-employed individuals. In the past you can self-certify’ your earnings; but in reality your hardly had a need to confirm your revenue at the all of the.

But not, so-called self-cert’ mortgage loans had been banned of the Monetary Make Power during the 2014 Home loan Sector Review and you will, subsequently all debtor need to prove their income to get a mortgage.

Very important paperwork

What lenders want out of mind-functioning home loan applicants may differ. Basically, you’ll want to tell you specialized is the reason 2 or 3 age no matter if some loan providers encourage one to year’s profile.

Whenever determining how much you earn yearly, lenders will generally assess the average income on the past a couple of otherwise three-years. As with mortgage loans to have operating individuals, most loan providers foot their home loan affordability calculations on the an enthusiastic applicant’s net cash contour (in advance of taxation).

Loan providers might inquire certain mind-functioning consumers for further proof to demonstrate that, as well as earning profits now, they’ll continue to do so afterwards. Such as, while you are a company director you might need to show research from dividend repayments or employed payouts. When https://paydayloanalabama.com/fulton/ you’re a company, you might need proof upcoming deals.

Just how affordability functions

After you have proved your earnings, the mortgage cost testing to own a personal-working applicant is the same as every other financial. The lending company can look at the money and you will outgoings to assess whenever you spend the money for amount you want to borrow.

Brand new testing will appear at the bank statements to see exactly what spent your money towards the, so it’s best if you end frivolous using regarding the half a year leading up to the application.

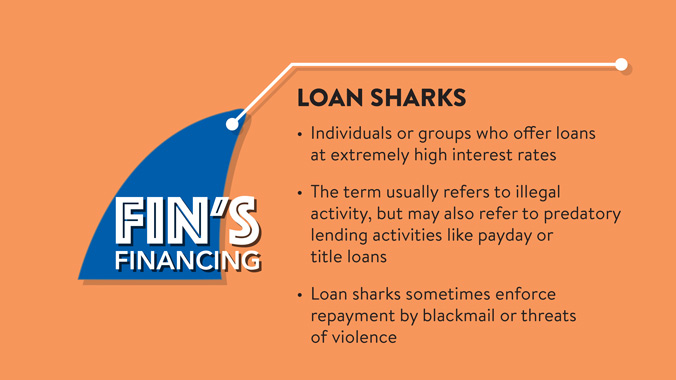

And you should completely avoid using that might appear because a good reddish flag’ to a lender, instance gambling on line or pay day loan.

As with any almost every other mortgage, the higher this new put you have, the higher your odds of invited and reduce the notice rate you’re going to be considering.

Free Home loan Suggestions

5-star Trustpilot rated on the web mortgage adviser, Trussle, makes it possible to choose the best mortgage – and works together with the lending company so you’re able to secure it. *Your house is repossessed unless you continue repayments on your own financial.

Taking accepted blog post-pandemic

Particular financial institutions, like NatWest, aren’t offering mortgage loans to help you worry about-working people who obtained money from the fresh new Self-employment Income Support Program. This is actually the instance, even in the event its income is steady before the pandemic in addition to their business is feasible blog post-pandemic.

HSBC says consumers who’ve removed provides are recognized, but nothing of the grant money can be used to service the loan app. It means notice-employed borrowers just who put features to change their earnings during the lockdown are in danger away from a failure the fresh bank’s cost monitors.

Some other issue is that loan providers usually use income on prior a few (otherwise about three) ages to evaluate affordability. Self-functioning professionals impacted by the fresh pandemic will in all probability have earned lower than common on tax 12 months 2020-21. So, so it drop within the earnings can affect the financial applications until 2023.

Extremely important alter

Santander’s financing plan now offers the new band of makes up notice-functioning individuals who possess suffered a from ordinary death of income. Very, affordability depends about how exactly far you generated into the 2019-20 and 2018-19.