Need for Credit, Financial obligation, and you may Offers When purchasing a property

Book out of Deceased No-deposit Free Spins Rules 2024

14 oktobra, 2024Book Of Ra 100 Kostenlose Spins Keine Einzahlung 2024 Deluxe Slot 2023 CropManage Knowledge Alkalische lösung

14 oktobra, 2024Need for Credit, Financial obligation, and you may Offers When purchasing a property

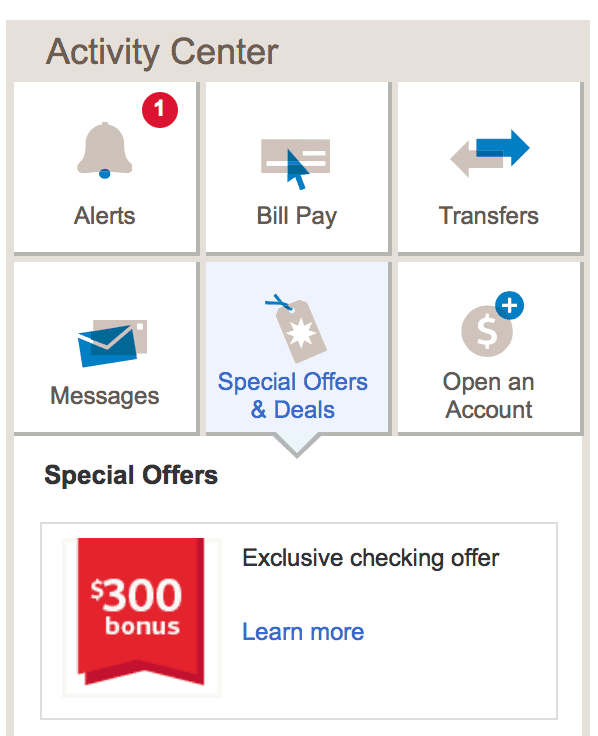

Youre making the fresh new Wells Fargo web site

Youre leaving wellsfargo and you may typing a web site one to Wells Fargo cannot control. Wells Fargo provides so it link for your benefit, but cannot promote which is not responsible for these products, features, stuff, backlinks, online privacy policy, or defense rules with the site.

When you purchase a house, look at the credit history, your debt, plus savings. Men and women around three pieces of economic guidance have a massive effect on the capacity to be eligible for that loan, get a competitive interest rate, and get the home you need.

The credit. The debt. Your own deals.

When you find yourself to acquire property, these are the about three chief products that go towards the choosing whether or not you will get recognized to have home financing, just what rate of interest you are going to be eligible for, or any other extremely important details you to feeling your first domestic get.

Your own borrowing from the bank

Your own credit try a way of measuring just how you managed financing, handmade cards, or any other money. Your credit history try placed in a credit file, whenever you are a credit score feels like a class that is provided based on the recommendations out of your credit file. It is utilized by lenders to test their creditworthiness since the an excellent borrower.

When you find yourself getting ready to get a house, it’s a good idea to start from the obtaining a copy of your credit history early; viewing it does let you know what lenders discover which help you to definitely most useful understand the pointers that assists influence the borrowing score.

A credit history is sold with almost all about your borrowing disease, at which playing cards you have got to just how long you’ve lived at the latest target. You could potentially to purchase your totally free annual duplicate of your credit report off annualcreditreport. You’ll be able to be able to acquisition a copy inside sixty times of are declined borrowing or if the report is incorrect on account of ripoff, as well as identity theft & fraud.

Something your credit report doesn’t come with, but not, will be your credit history. Often, you can buy your credit rating for free out of your financial. A higher credit score basically form you may be handling the credit better, maybe not borrowing from the bank more than you really can afford, and paying all your costs promptly. A high credit history can get mean all the way down rates plus selection to your a mortgage because loan providers use your credit rating so you can assist decide if or not they’re going to agree your application for a financial loan.

The most common credit rating are an excellent FICO (Reasonable Isaac Corporation) credit rating , and that generally speaking ranges of three hundred so you’re able to 850. The greater the score, the greater number of choices you will find in the getting a home loan. Each of the around three biggest credit bureaus – Equifax , TransUnion , and you will Experian – declaration your credit score. Keep in mind that each one of these bureaus spends a slightly various other rating design, so your rating can vary some from a single bureau to another.

When a lender actually starts to review debt wellness as an ingredient of your mortgage application, they use another kind of credit report. It is titled good tri-combine credit history therefore combines reports off the about three big credit rating bureau account on the that report. Since statement does not mix the credit results away from for every single agency it will list all about three. Really lenders use the middle score for finance versus a great co-debtor or perhaps the straight down of these two center ratings when the around are an effective co-debtor.

Additional loan providers enjoys other guidance, definition your credit score you can expect to qualify your for a loan at you to lender but not an alternative. Please remember that your particular credit score is one of of numerous points – just like your money, monthly financial obligation payments, and you can credit rating – that influence loan-recognition conclusion. For those explanations, i don’t have a predetermined score one guarantees you’ll receive a home loan.

Your debt

When you submit an application for a home loan, loan providers will look at the personal debt to aid determine whether your have enough money for accept yet another payment. They normally use a formula entitled personal debt-to-income ratio (DTI).

Personal debt isn’t necessarily a terrible on a credit card applicatoin, so long as your complete obligations doesn’t exceed a certain payment of income. Which have an obligations-to-money ratio from thirty five% or faster is a great guideline.

At the same time, having zero loans and no handmade cards might actually lower your credit history because you aren’t strengthening a history of good credit habits.

However, you should know that and come up with large orders having finance otherwise playing cards, or starting an alternative mastercard membership in advance of applying for a home loan, could possibly get feeling what you can do to meet the requirements – very consider carefully your need and you will goals cautiously.

The coupons

If you are considering to get a house, you will have to keeps money on give to fund expenses, along with down-payment and you can closing costs.

You will also need to pay to the will cost you associated with closure the americash loans Franktown fresh profit on your domestic, which includes origination costs getting a mortgage, legal costs, property review, and much more.

Very lenders would like to know you’ve got sufficient money in deals to pay for months out-of financial, tax, and you may insurance costs with the a home – and additionally income to pay for your own monthly homeloan payment.

Lenders are necessary to make sure the source of your own closure and down-commission money, and whether or not a fraction of your own down payment are a financial present out of a family member, friend, manager, or nonprofit business.

Insights your credit report and you may credit history

Your credit report and you can credit score get feeling what kinds of loans you might be provided, plus the interest rate and you can loan amount.