How is certian FHA Distinct from Heading Old-fashioned?

Cash Genius Ports Dollars Genius free spins on Fruit Blast Casino slot games On the internet

23 oktobra, 2024Cashapillar position by Microgaming review enjoy on mahjong 88 slot uk the internet 100percent free!

23 oktobra, 2024How is certian FHA Distinct from Heading Old-fashioned?

An FHA mortgage are an interest rate which is meant for low-money homebuyers. The loan is covered by the Federal Property Government, and this title. The benefit is you don’t need to build an incredibly high deposit that’s a reduction to reduced-money parents who wish to pick a home.

Willing to Begin the brand new FHA Financing Processes?

As mentioned prior to, one of the primary gurus would be the fact it doesn’t wanted a large deposit. In addition to this, you will find some almost every other pros also. For-instance, while antique mortgage necessitates that the latest individuals need an effective credit history, he is provided if you have an averagely a good credit score records. As well, they have fixed interest rates and a loan label out of fifteen in order to three decades.

What are the Eligibility Standards when deciding to take aside an FHA Financing?

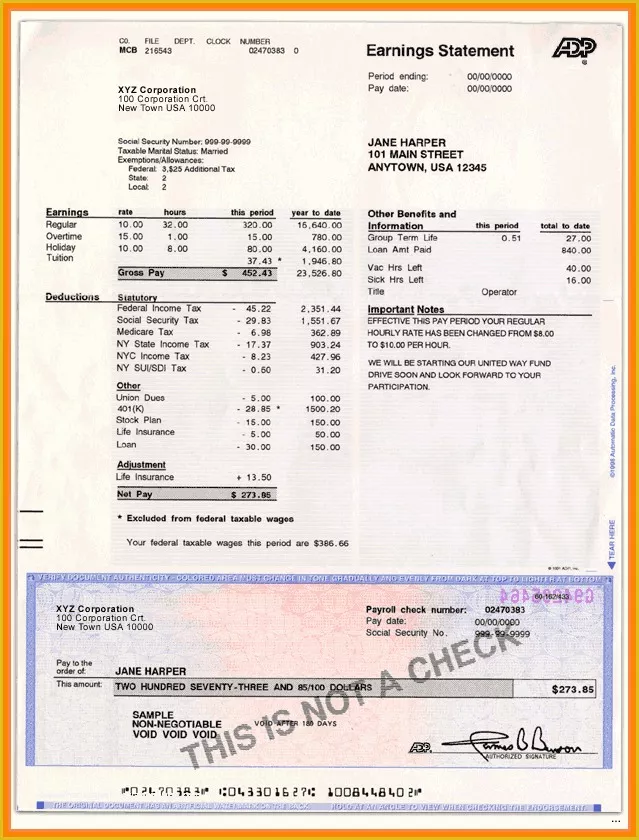

- So you’re able to sign up for an FHA financial, you need to provides a social Security amount that is good and you may should be out-of courtroom many years to sign a mortgage on the condition for which you are usually residing.

- When you’re FHA funds is granted in matter of an average credit history, you should keeps a get anywhere between five hundred to help you 580 from inside the a credit score are priced between three hundred and 850. Concurrently, if you encountered personal bankruptcy, you should be at the very least 2 yrs from it and you may should have re also-founded a significant credit rating once you are applying.

- They are granted only immediately after your property encounters a beneficial basic appraisal procedure and because associated with the, the crucial thing that your household fulfill right criteria if it pertains to design.

- You also need to own a reliable a career background. The latest FHA necessitates that to be qualified, you’ll want worked with your current boss for around couple of years.

- They are supplied only when the obligations, i.elizabeth. the loan in addition to all other expense such as for instance pupil financial obligation, automobile financing, and you may charge card payments slide lower than 50 percent of one’s full income.

Just what Any time you Understand Before you take away an FHA Home loan?

- Home loan Insurance coverage PremiumsIf you’re taking out an enthusiastic FHA mortgage, you are expected to spend a home loan Insurance premium. Most other loan products such as for instance old-fashioned fund simply need financial insurance policies in the event that a down payment of lower than 20% is created. That it acts as a security blanket to your bank but if a purchaser does not shut down the borrowed funds. The fresh MIP may vary according to the loan amount, financing label, and the percentage of down-payment.

- To purchase one minute HomeOnce you’ve got funded the acquisition away from a good home, you’re not allowed to submit an application for an additional FHA financing to finance the purchase away from another type of house. On top of that, the consumer would be to move into the house within this 60 days away from closure the purchase and ought to entertain the property having a minimum of just one year.If you want any longer information regarding FHA mortgages, please contact us.

- FHA Funds Of the State:

- Ny FHA Fund

Start your house Financing Processes Today With Jet Head Cellular

The audience is invested in putting some home loan application process as simple as possible. Compared to that stop, we have set up our cellular app, Jet Direct Mobile.

Sprinkle Lead Money Corp.DBA Spray Head MortgageDBA Elderly Contrary Network111 Western Fundamental Road, Package 110Bay Coast, Ny 11706toll-free: 1-800-700-4JET fax: 631-731-4531 NMLS: 3542 NMLS Consumer Availability

Spraying Direct Financial 2024. All the Liberties Kepted. Alabama Consumer credit Licenses – License/Membership #22632; Arizona Financial Banker License – Lic/Reg#:1040763; Signed up by Department of Monetary Shelter and you may Invention under the Ca Home-based Mortgage Financing Work – #41DBO-81230; Texas Mortgage company Subscription #LMB100014791; Connecticut Lending company Licenses #20333; Delaware Lender Permit – License/Subscription #032943; Fl Lending company Servicer Permit #MLD357; Subscribed from the Georgia Institution from Financial and you may Finance company License Team – Permit #64345; Illinois Domestic Home loan License – Lic/Reg#:MB.6850070; Indiana DFI Home loan Lending Permit No. 59981; Maine Overseen Lender Permit Zero. SLM9525; Maryland Home loan company License #17365; MA Mortgage lender License #ML3542; Michigan very first Mortgage broker/Lender/Servicer Registrant #FL10015703; Signed up Home-based Mortgage lender New jersey Dept out of Banking & Insurance rates #3542; The new Mexico Home loan Providers License 3542; Authorized Home loan Banker NYS Agencies out-of Monetary Features #B500903 NMLS#3542; North carolina Lending company Licenses L-180193; Kansas Large financial company Operate Mortgage Banker Exclusion # MBMB.85; Oregon: State out-of Oregon ML-3542; Pennsylvania Mortgage lender Permit No. 47421; South carolina-BFI Mortgage lender / Servicer Licenses Multiple listing service3542; installment loans in Columbus Mississippi Tennessee Home loan Licenses – License/Subscription #17365; Texas SML Mortgage Banker Subscription; Virginia Permit/Membership # MC-4985; Arizona Institution out of Financial institutions, Unsecured loan Organization Licenses CL-3542; Wisconsin – Home loan Banker License, #ML3542;